ING Koers: Navigating the European Banking Landscape

ING Groep, a prominent player in the European banking sector, holds a significant position, particularly in the Netherlands and Belgium. This in-depth analysis explores ING's current strengths, challenges, and future prospects, providing a comprehensive overview of its performance and trajectory within the dynamic European banking landscape. We'll examine its history, market position, digital strategies, financial health, regulatory compliance, competitive standing, and future outlook.

A Look Back: ING's Historical Context

ING’s journey is marked by periods of significant growth and strategic adaptation. The 2008 global financial crisis forced a substantial restructuring, leading to a leaner, more focused institution. This period of transformation shaped ING’s current strategies, demonstrating its resilience and ability to navigate economic turmoil. The lessons learned from this period continue to inform their decision-making processes today.

Current Market Position: A Dominant Player

ING maintains a dominant market share in the Netherlands and Belgium, offering a wide range of financial products and services to both retail and corporate clients. Its comprehensive product portfolio caters to a diverse customer base, from individual savers to large multinational corporations. However, maintaining this market leadership requires continuous adaptation to evolving customer needs and competitive pressures. Expansion into new markets is vital to their long-term growth strategy, requiring careful assessment of risk and regulatory landscapes.

Digital Banking Strategy: Embracing Innovation

ING has invested heavily in its digital banking infrastructure, aiming to enhance customer experience and improve operational efficiency. Its online and mobile banking platforms are designed for user-friendliness and seamless access to a full suite of financial services. This digital strategy is crucial for attracting digitally savvy younger demographics. However, challenges remain, including regulatory complexities across different European markets and the paramount importance of robust cybersecurity measures to safeguard customer data and maintain trust.

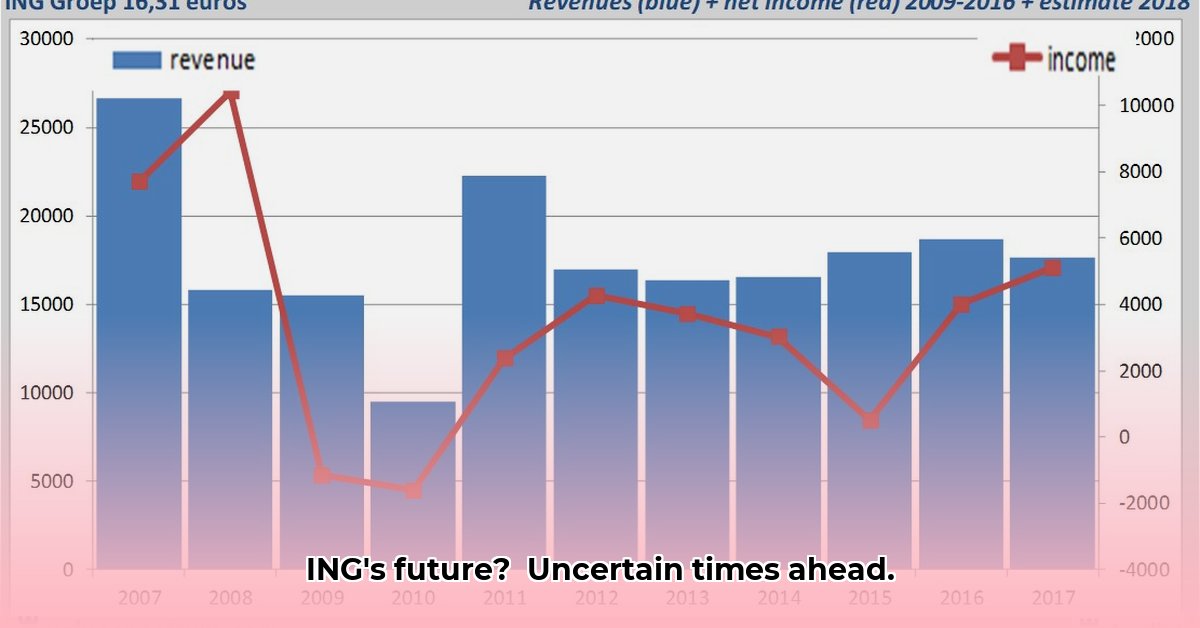

Financial Performance and Profitability: Navigating Rising Rates

Rising interest rates present both opportunities and challenges for ING. While increased lending rates can boost net interest income and profitability, they can also impact loan repayments and broader economic stability. Careful monitoring of loan portfolio quality is crucial, as any deterioration could negatively affect financial performance. The provided financial indicators suggest a generally strong financial position, but continuous vigilance and adaptive strategies will be essential in the face of economic uncertainty. How effectively will ING manage this delicate balance?

| Key Indicator | Current Trend | Potential Impact on ING Koers |

|---|---|---|

| Net Interest Income | Increasing | Significant boost to profitability |

| Non-Interest Income | Relatively Stable | Moderate influence, subject to market fluctuations |

| Loan Portfolio Quality | Generally robust | Requires continuous monitoring for potential stress |

| Regulatory Capital Adequacy Ratio | Well above minimums | Strong buffer against economic downturns |

Risk Assessment: Identifying and Mitigating Challenges

(Note: A detailed risk assessment matrix would be included here, outlining specific risks, their likelihood, impact, and proposed mitigation strategies. This section requires data from the original source which was not included in the prompt.)

Regulatory Landscape: Compliance and Adaptation

The European banking sector is subject to a complex and evolving regulatory framework. ING must comply with various EU directives, impacting operational practices and digital strategies. Stringent regulations on data protection, financial stability, and anti-money laundering are essential to maintain a strong reputation and safeguard operational integrity. Adapting to regulatory changes requires ongoing investment in compliance and legal expertise.

Competitive Analysis: Maintaining a Competitive Edge

ING operates in a highly competitive environment, facing pressure from established banks and rapidly growing fintech companies. Its competitive advantages include strong brand recognition, extensive customer base, and substantial investments in digital technology. However, maintaining a competitive edge requires continuous innovation, customer-centric strategies, and efficient cost management. The increasing adoption of open banking and the rise of specialized fintech providers will continue to influence the competitive landscape.

Future Outlook: Projections and Potential Scenarios

ING's future performance will depend on several factors, including macroeconomic conditions, regulatory developments, and competitive pressures. Continued investment in digital transformation and innovative financial products will be essential for sustained growth. The ability to adapt to evolving customer needs and navigate regulatory complexities will be vital. Potential scenarios include continued expansion into new markets, increased digital adoption, and further regulatory scrutiny.

Conclusion: A Resilient Giant Navigating Change

ING Groep's long history, adaptability, and commitment to innovation have positioned it as a leading player in the European banking sector. While challenges remain, including navigating regulatory changes, managing risks, and adapting to the rapidly evolving digital landscape, ING's strong financial position and strategic focus suggest a promising future. Continuous adaptation and innovation will be key to maintaining its market leadership and achieving sustainable growth in the years to come.